Further changes to the Statement of Comprehensive Income

The “old” Income Statement has undergone many and frequent changes over the last number of years. Firstly, the “old” Income Statement changed to the Statement of Comprehensive Income, which includes other comprehensive income, for example, revaluation gains on property, plant and equipment, revaluation gains on available-for-sale financial assets, etc.

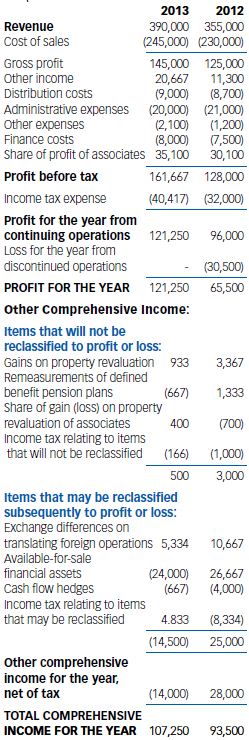

The Statement of Comprehensive Income has now changed to the Statement of Profit or Loss and Other Comprehensive Income, as well as an additional requirement for entities to group items presented in other comprehensive income on the basis of whether they are potentially reclassifiable to profit or loss subsequently (reclassification adjustments).

How it works

For annual reporting periods beginning on or after 1 July, 2012, a complete set of financial statements consists of:

- a statement of financial position as at the end of the period;

- a statement of profit or loss and other comprehensive income for the period*;

- a statement of changes in equity for the period;

- a statement of cash flows for the period;

- notes, comprising a summary of significant accounting policies and other explanatory information, and

- a statement of financial position as at the beginning of the earliest comparative period when an entity applies an accounting policy retrospectively or makes a retrospective restatement of items in its financial statements, or when it reclassifies items in its financial statements.

*Please note that an entity may continue to use the title ‘Statement of Comprehensive Income’ instead of ‘Statement of Profit or Loss and Other Comprehensive Income’.

An entity may present a single statement of profit or loss and other comprehensive income, with profit or loss and other comprehensive income presented in two sections. The sections shall be presented together, with the profit or loss section presented first followed directly by the other comprehensive income section.

However, an entity may present the profit or loss section in a separate statement of profit or loss. If so, the separate statement of profit or loss shall immediately precede the statement presenting comprehensive income, which shall begin with profit or loss.

Disclosure of potential future reclassification adjustments

The other comprehensive income section shall present line items for amounts of other comprehensive income in the period, classified by nature and grouped into those that, in accordance with other Australian Accounting Standards:

- will not be reclassified subsequently to profit or loss, and

- will be reclassified subsequently to profit or loss when specific conditions are met.

This new requirement does not remove the option to present profit or loss and other comprehensive income in two statements. The new requirement also does not change the option to present items of other comprehensive income either before tax or net of tax. However, if the items are presented before tax then the tax related to each of the two groups of other comprehensive income items (those that might be reclassified to profit or loss and those that will not be reclassified) must be shown separately.

Reclassification adjustments are items recognised in profit or loss that were previously recognised in other comprehensive income (commonly referred to as ‘recycling’) and AASB 101 Presentation of Financial Statements requires their disclosure. The following are examples of reclassification adjustments:

- the disposal of a foreign operation (as required by AASB 121 The Effects of Changes in Foreign Exchange Rates);

- the derecognition of available-for-sale financial assets (as required by AASB 139 Financial Instruments: Recognition and Measurement), and

- forecast transactions affecting profit or loss (as required by AASB 139).

- Under these accounting standards, unrealised gains may have been recognised in the current or previous periods. On reclassifying these unrealised gains to profit or loss, it is necessary to deduct them from ‘other comprehensive income’, otherwise they will be ‘double-counted’ in total comprehensive income.

- Some AASBs require that gains and losses recognised in other comprehensive income should not be ‘recycled’ to profit or loss, and hence will not give rise to reclassification adjustments. AASB 101 gives the following examples:

- revaluation surpluses for revalued property, plant and equipment, and intangible assets, and

- actuarial gains and losses on defined benefit plans.

- Whilst revaluation surpluses for revalued property, plant and equipment, and intangible assets, are not reclassified to profit or loss, they may be transferred to retained earnings as the assets concerned are used or derecognised.

The implementation guidance to AASB 101 provides the following illustration of a single statement of profit or loss and other comprehensive income:

Aletta Boshoff